Employee benefits

- You choose how much you want to donate from each payslip.

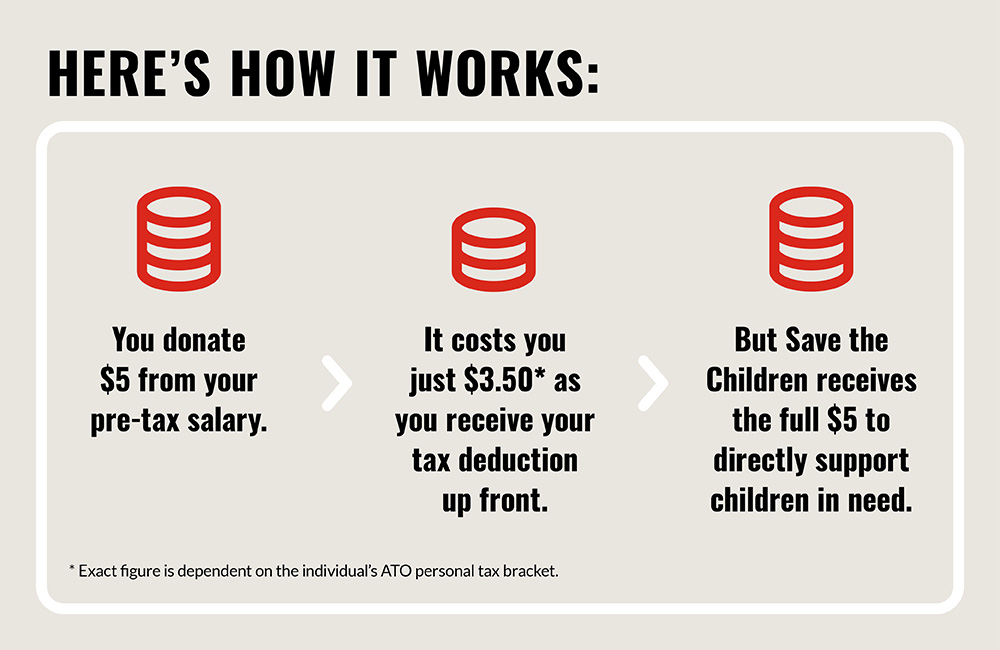

- By donating from your pre-tax salary, you’ll automatically receive your tax deduction for your donation up front. So no need to keep receipts to claim it back come tax time.

- Your Payroll Team will simply provide a statement of your year’s donations along with your Group Certificate at the end of the financial year.

- It’s cost-effective and efficient - by donating from your pre-tax salary it costs you less to give Save the Children more.

- Complete this form to join our Workplace Giving Program.

Employer benefits

A strong and successful program can benefit your organisation by:

- Creating high impact for low cost - Running a Workplace Giving program is a low cost, high impact way to enhance your organisation’s social responsibility reputation.

- Improving staff engagement - studies have shown that 74% of participants involved in Workplace Giving enhanced their motivation at work.*

- Increasing your ROI - Employers with highly engaged employees are said to deliver 7x greater five-year total shareholder returns than organisations with low employee engagement.~

- Attracting quality talent - 72% of young Australian workers want to work for an organisation that is highly involved in the community.*

- Enhancing your reputation - being involved in meaningful and impactful work enhances relationships with customers and clients, stakeholders and the broader community.

Together we can engage your staff, enhance your reputation and make the world a better place for children, today and tomorrow.